A factory construction boom fueled by reshoring is surging in the U.S. The growth is being driven by a U.S. policy push to boost domestic clean-energy manufacturing, by global supply chain risk, and by the total cost of ownership (TCO) equation. Almost 60 percent of the spending is attributed to construction for chips, EV batteries and other electronic manufacturing.

Manufacturing’s share of construction spending hit 30-year highs in April and May. U.S. construction spending by manufacturers has more than doubled in the past year, reaching an annual rate of almost $190 billion in April compared with $90 billion in June 2022.

The growth in U.S. factory construction is being driven by a policy push to boost domestic manufacturing of clean-energy products and semiconductors. Source: Treasury Department

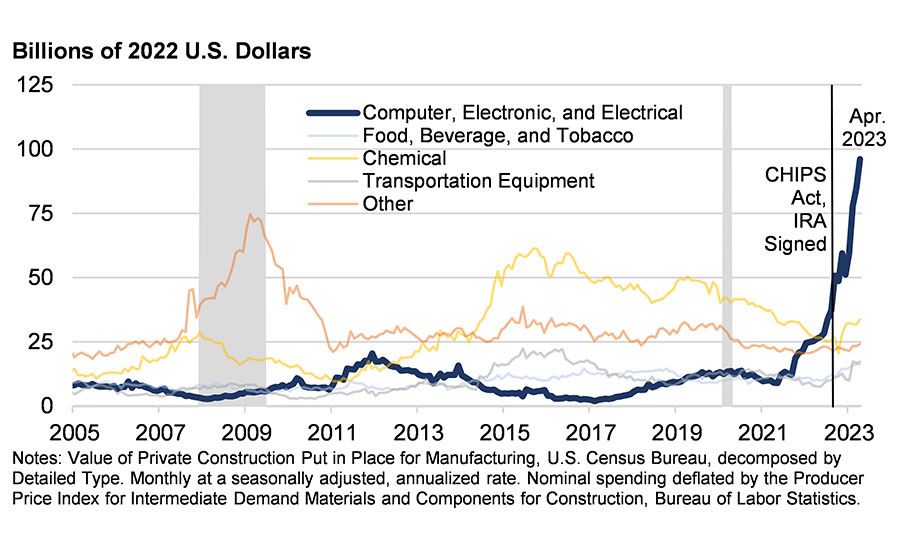

A recent briefing from the U.S. Department of the Treasury, reviews the reasons behind the “doubling of real manufacturing construction spending since the end of 2021 and…the near quadrupling of real construction spending on computer, electronics and electrical manufacturing.”

The Treasury Department notes that “the surge appears to be uniquely American.” In other words, other advanced economies have not experienced similar manufacturing construction surges. Although the prevailing component of the U.S. manufacturing boom is in the computer and electronics segment, it has not been offset by reduced spending in other manufacturing construction segments.

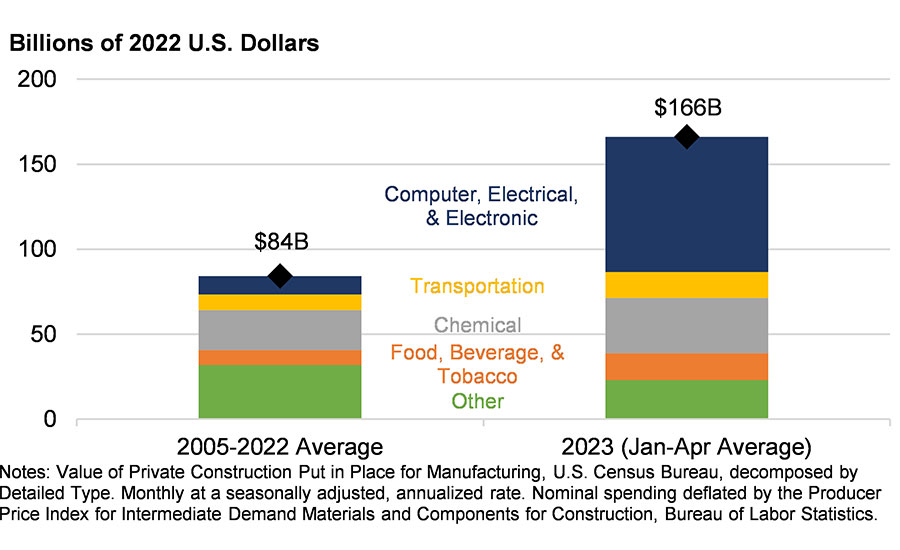

In the first quarter of this year, average spending on U.S. factory construction is more than double the average from the past 17 years. Source: Treasury Department

The Reshoring Initiative’s data concurs on the magnitude and focus of the investment, with EV battery and semiconductor investments accounting for the largest portions of job announcements in 2022, a 53 percent increase from 2021. Manufacturing job announcements continued to outpace recent records, adding 101,500 jobs in 2023 Q1.

Clean Energy and Semiconductors

The investment and manufacturing construction phenomenon in the U.S. is unlike anything seen in decades. In the past year, companies have announced nearly 200 new projects totaling more than $110 billion of investment in clean-energy projects.

For example, Maxeon Solar Technologies Ltd. plans to spend $1.2 billion to build the biggest U.S. factory for polysilicon solar panels. Ford Motor Co. plans to build a $3.5 billion EV battery plant in Michigan, creating 2,500 jobs. Hyundai and South Korean battery maker SK plan to set up a joint venture to build a $5 billion battery plant in Bartow County, Georgia.

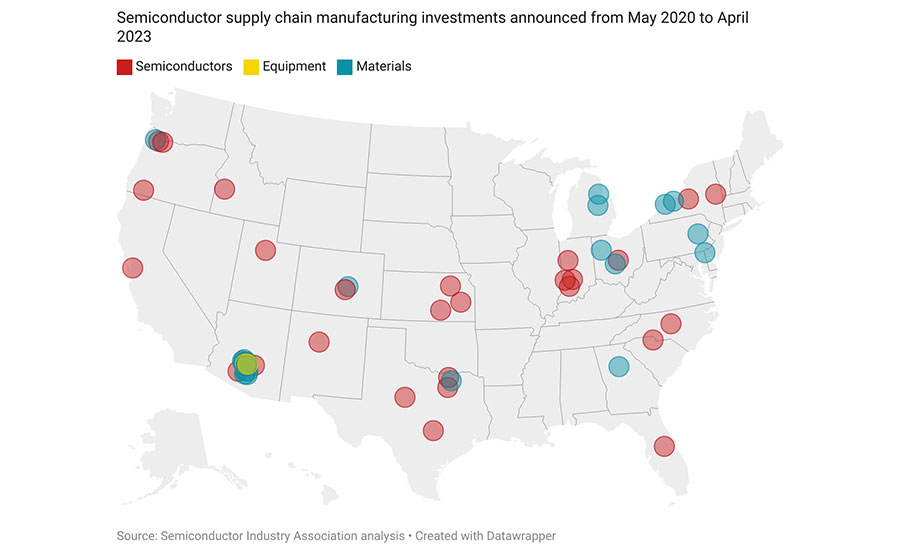

A similar trend is occurring in the semiconductor industry. To date, more than 50 new semiconductor ecosystem projects and $210 billion in private investment have been announced, which will reduce dependence on critical products and technologies from China. For example, Wolfspeed Inc., a leading manufacturer of semiconductors, will create 1,800 new jobs with an investment of approximately $5 billion over the next eight years in North Carolina. The semiconductor supply chain includes new semiconductor manufacturing facilities, expansions and suppliers of the materials and equipment used in chip manufacturing. Chronic supply shortages threaten infrastructure, military defense systems, medical equipment, automobiles, and various electronic devices.

To date, more than 50 new semiconductor ecosystem projects and $210 billion in private investment have been announced. Source: Semiconductor Industry Association

Fueling the Construction Surge

U.S. policy has created favorable conditions for reshoring and foreign direct investment via the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and CHIPS and Science Act. Each provides funding and tax incentives to spur on U.S. manufacturing where the U.S. has an excess dependency on imports.

Some of the states that have won manufacturing investment have provided state-level tax incentives, ensured the availability of shovel-ready sites and worker training, and invested in infrastructure.

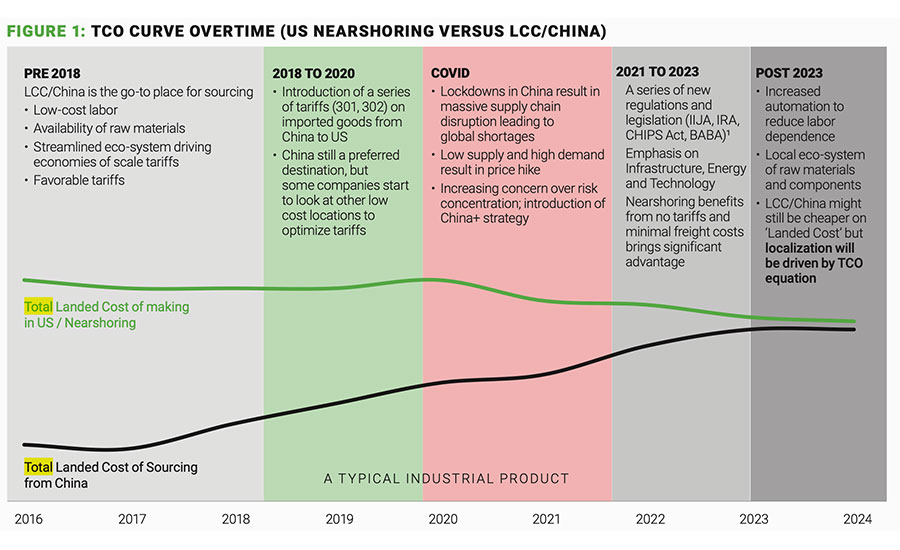

Shifts in the global supply chain via sustained disruption and geopolitical risk are driving more companies to use TCO estimating for location decision-making. Markedly rising wages in China, increasing use of automation in the U.S., and new trade policies have “reduced the total cost gap between Asian production and nearshoring to almost zero.”

It is clear from the report that the authors are using “nearshoring” to mean localization, including both reshoring to the U.S. and nearshoring to Mexico and Canada.

Markedly rising wages in China, increasing use of automation in the U.S., and new trade policies have reduced the total cost gap between Asian production and nearshoring to almost zero. Source: Alix Partners

The TCO Equation

TCO is the best metric to use for comparative analysis. The Reshoring Initiative’s TCO Estimator is a free online tool that helps companies account for all relevant factors to compare the true total cost of domestic and offshore sourcing and siting. These factors include overhead, balance sheet, risks, corporate strategy, and other external and internal business considerations. Shifting decisions from a price basis to TCO can be expected to drive reshoring of 20 to 30 percent of what is now imported.

Are you thinking about reshoring? For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org. Our main mission is to get companies to do the math correctly using TCO Estimator. By using TCO, companies can better evaluate sourcing, identify alternatives, and even make a case when selling against offshore competitors.